One of the key paths to financial and fiscal growth is understanding responsible leverage. Just like a hip toss or a flip, your financial movements will require momentum, which is where understanding credit and the philosophy behind the decision-making process can be so valuable for the journey. Businesses of all sizes must understand this to survive and ultimately thrive. The feature topic for discussion tends to focus on business lending. To a large degree, your personal finances are no different.

Also, with more people diversifying their income streams and pursuing endeavors than can provide additional income, we are all businesses onto ourselves to varying degrees.

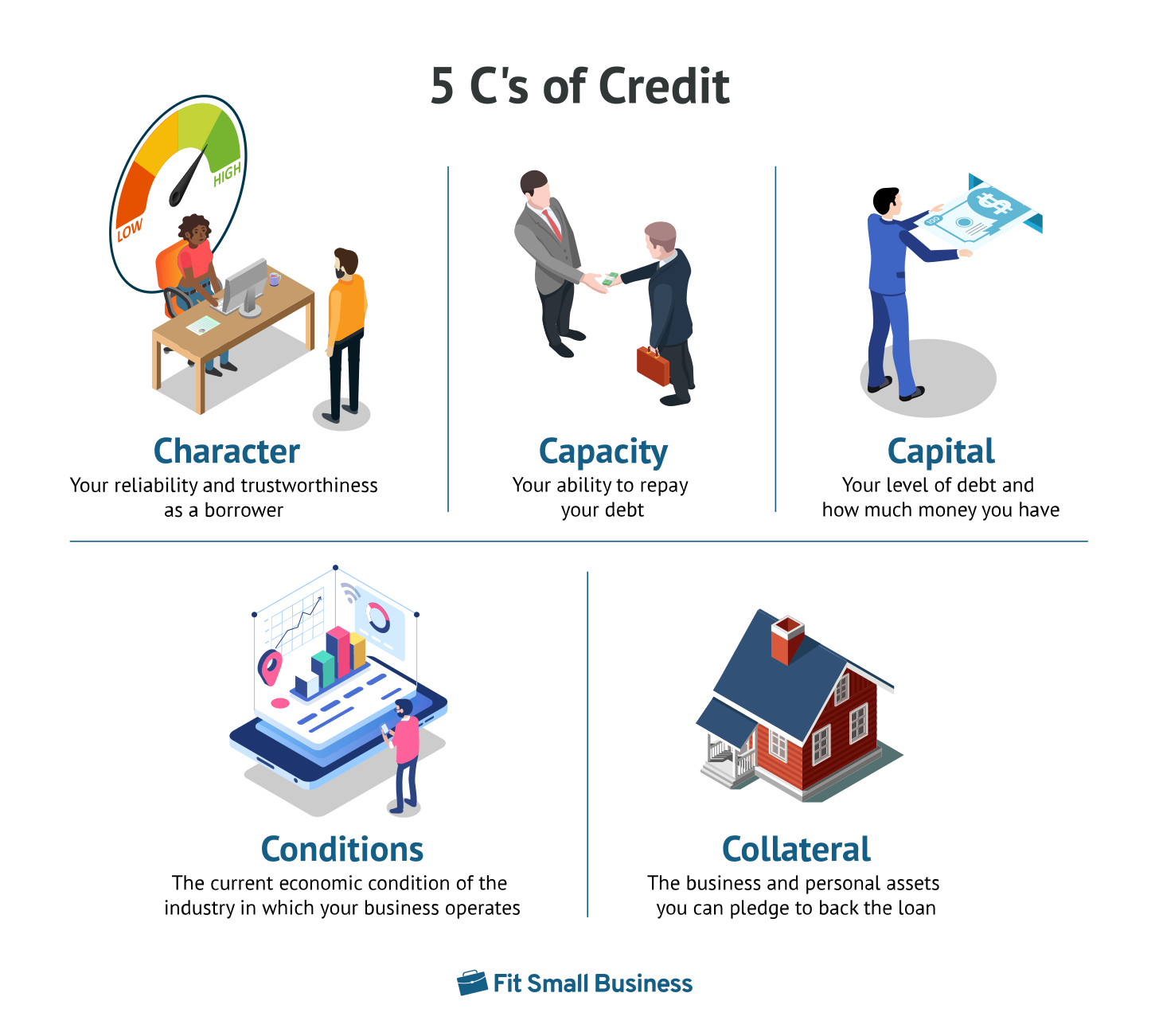

What Are the 5 C’s of Credit

When we talk about credit, we should think about the Five C’s. This will help us with the foundation of building good credit habits. Whether credit for personal use or business lending, this topic underpins how lenders create and manage firm offers of credit.

So what are the Five C’s of Credit?

Character

Capacity

Capital

Conditions

Collateral

Below is an illustration provided by one of my favorite resources for small business knowledge, Fit Small Business. While the focus is on small business and business lending, this concept applies to everyone with a financial ninja approach.

Let’s take a deeper dive into each of the 5 C’s

Character

This may be the most important of all the Cs. It offers a historical glimpse into past financial behaviors and an indicator of what may come in the future (although nothing can ever be guaranteed). Simply put, when no one is looking or when no one knows your financial circumstance, will you continue to honor your agreements and commitments?

Character speaks to also avoiding potential financial pitfalls when possible. Some of the best decisions are the ones not made. For example, when you don’t make that impulse purchase because you have momentum with building your savings plan. Another example is when you are bootstrapping your business and avoiding unnecessary cash going out that do not truly provide a return on the investment that makes sense.

You totally get this as a financial ninja. You may be working towards financial ninja status by strengthening your financial character with the desired goal of stewardship and discipline.

Capacity

This “C” speaks to making sure the math works when evaluating someone’s ability to repay with appropriate terms and conditions. Going a little deeper, this is all about cash flow. Do I have enough cash on hand to pay my obligations and still afford a sustainable standard of living? Common terminology like debt to income ratio, payment to income ratio, and utilization of available credit are some of the factors that may impact someone’s ability to repay.

The more you use your existing credit products to its limits, the more risky you will become to a lender. Managing your capacity is used as an early prediction of your credit future.

Capital

This context, derived from capitalism, speaks to the big picture scenario of someone’s net worth. In other words, after taking inventory of all assets versus all liabilities, what’s left over would be your net equity or less deficit if they’re under water. Of course, we want to be as positive as possible. The bigger the net equity position, the less risky, the safer, and the better credit terms may be.

Conditions

While the other 4 C’s are more discussed, conditions sometimes get less shine because of what it represents. It represents two very sensitive topics that can be difficult to navigate. The first example is “economic conditions.” Think about the pandemic from 2020 as an adverse economic condition. We can all agree that economic conditions during those two or so years were not the same for many people compared to previous cycles in the economy. When the economic conditions are difficult, it will be more difficult to borrow money generally. Businesses may not be able to keep employees because they lose their customers and it can become an avalanche. Like driving on a clear road with little traffic vs. being in rush hour traffic. Everything is just more difficult when the conditions are not optimal.

The second example is the condition of how a borrower intends to use funds granted. This can sometimes be sensitive and potentially feel like an invasion of privacy. However, we have to remember that loan dollars can be used for all kinds of reasons (good and bad). The lender is still required to lending money safely and responsibility in these economic situations. When times are tougher, more scrutiny may be needed in order to ensure that risk/reward analysis makes sense to the investors/stakeholders/members who are backing the lender.

Collateral

Collateral is one of the most popular C’s in the 5 C’s of credit. Collateral simply helps the lender lower their risk because the borrower is giving something of value to the lending agreement upfront. It’s not just your credit history and your income that is being used. Instead, here is something else to motivate a yes decision like: a vehicle, cash accounts, property, etc.

For example, I need to borrow some money to pay off a high-interest rate credit card at 20% APR. Without collateral (using a personal loan), the lender would look at my credit history/score/experience and my income. If they say yes, my interest rate may be 10% - 12% in ideal situation.

However, if I have my car title to pledge as collateral, I may save a significantly larger amount of interest with a rate of 5%. For illustrative purposes, you can see how collateral can offer a better savings opportunity.

As a general rule, collateral generally helps lower the risk to the lender and lower the interest rate price to the borrower which can be a potential win-win in many cases.

Summary

As an aspiring Steward, having some of the basics of how credit works will go a long way with making good financial decisions along your journey. Let discipline, focus, and consistency be your guide.

Be a Good Steward Everywhere You Go

I have exciting news to share: You can now read A Steward’s Journey in the new Substack app for iPhone.

With the app, you’ll have a dedicated inbox for my Substack articles and others you subscribe to. New posts will never get lost in your email filters or stuck in spam. Longer posts will never be cut off by your email app. Comments and rich media will all work seamlessly. Overall, it’s a big upgrade to the reading experience.